Case Studies

Here is an overview of our past projects. Experience our successful execution of value-add projects by clicking on the orange arrows below.

ABOUT THIS PROJECT

In May 2014, Pat Lowery and Jeff Barone acquired the fee interest in the historic Hotel Lennox out of foreclosure (following a failed $30M+ redevelopment of the building in 2002) after a strenuous two-year negotiation with bond holders and city/state officials. The value add project included amending a TIF, two tax incentive districts, a new long term parking lease, securing 10 year tax abatement, and structuring State and Federal Historic Tax Credits.

Following the acquisition, Barone and Lowery fully redeveloped the shuttered, 24 story Federally registered building. The complete redevelopment included converting the building to the popular Courtyard by Marriott select service brand to optimize the operating model and leverage the brand distribution. Additionally, the hotel was custom designed with a mid-century modern feel to complement the historic elements of the building and provide guests with a more modern, design forward experience. The project was completed on schedule and under budget, and less than 1-year after opening the hotel investors were paid their initial preferred coupon and received their allocated Federal Historic Tax Credit (which represented 39% of their initial investment).

The hotel’s location is widely considered one of the best in downtown St. Louis as it is the only hotel that is connected to Convention Center and on Washington Avenue, the popular entertainment and nightlife district. Capitalizing on the hotel’s preferred location, superior room product, and optimized operating model and brand, the Courtyard is on track to exceed year one’s original underwritten market share and NOI.

- Complicated, multiparty transaction that involved a foreclosure, amending a TIF, and two incentive districts

- Extremely well located as the only hotel in St. Louis connected to the Convention Center

- Federally registered historic building that had received a $30M+ renovation in 2002

- Off market transaction through Sponsor’s strong relationship with Seller’s representative

- Successful structuring of Federal and State Historic tax credits to materially reduce the project’s basis

- Fully redeveloped the building on schedule and under budget

- Optimized the operating model and brand with Courtyard by Marriott

- Investors paid their preferred coupon and received their allocated Federal Historic Tax Credit less than 1-year after opening.

Downtown/Convention Center

DESCRIPTION

Boutique Hotel

FACILITIES

165 rooms, Bistro, Fitness Ctr

May-2014

TOTAL INVESTED

$22 million

EQUITY INVESTED

$7.5 million

GROSS RETURN

Projected in excess of 20%+

THE CARLYLE, New York, NY

*Prior Affiliation Property

- Under-marketed historical property

- Operated by an unsophisticated absentee owner

- Hotel in need of a renovation

- Unencumbered by brand and management

- Excess real estate to monetize

- Successful rebranding and instilled finer operating procedures

- Repositioned guestrooms and public areas through complete renovation

- Purchased and renovated coop units to add to hotel inventory

Upper East Side, Manhattan

Best in market luxury hotel

April -2001/July – 2011

187 guest rooms within a coop structure, 15,000 sf retail, 140-space garage

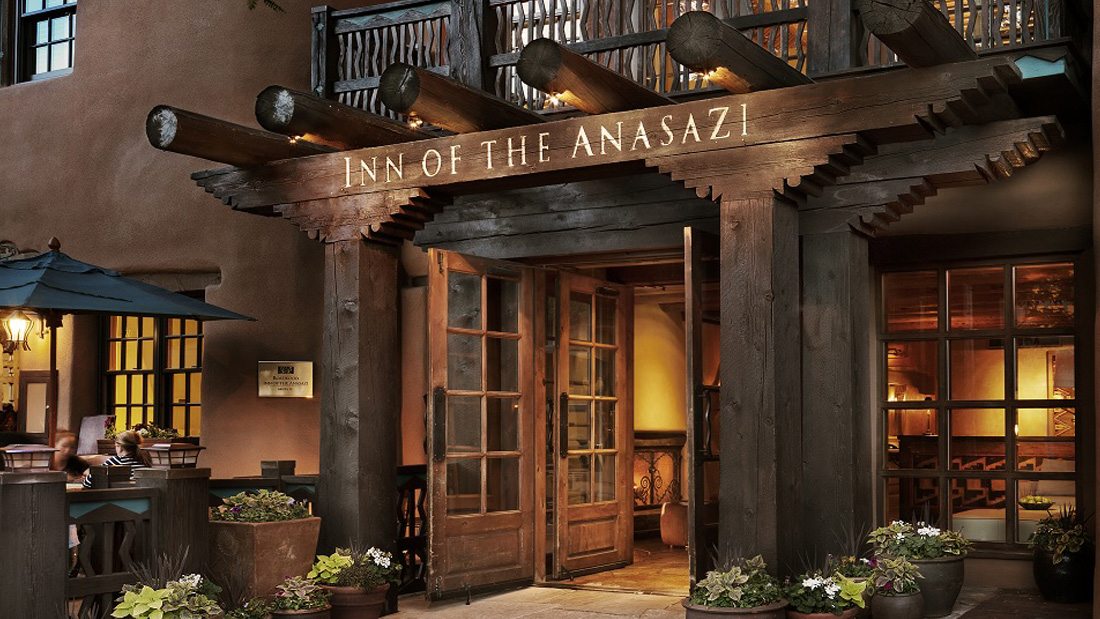

INN OF THE ANASAZI – Santa Fe, NM

*Prior Affiliation Property

- Best in market hotel and location

- Lack of sophisticated sales and marketing capabilities due to independent management

- Hotel in need of a renovation

- Unencumbered by brand and management

- Successful rebranding and implemented stronger sales tactics

- Repositioned guestrooms and public areas through complete renovation

- Capitalized on exit by selling unencumbered of brand and mgt to strategic trophy Buyer

Downtown Santa Fe just off the Plaza

Best in market luxury hotel

October – 2005 / July – 2011

57 guest rooms, 1,100 sqft of mtg space